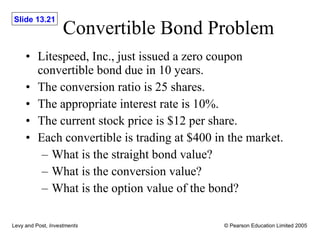

42 zero coupon convertible bond

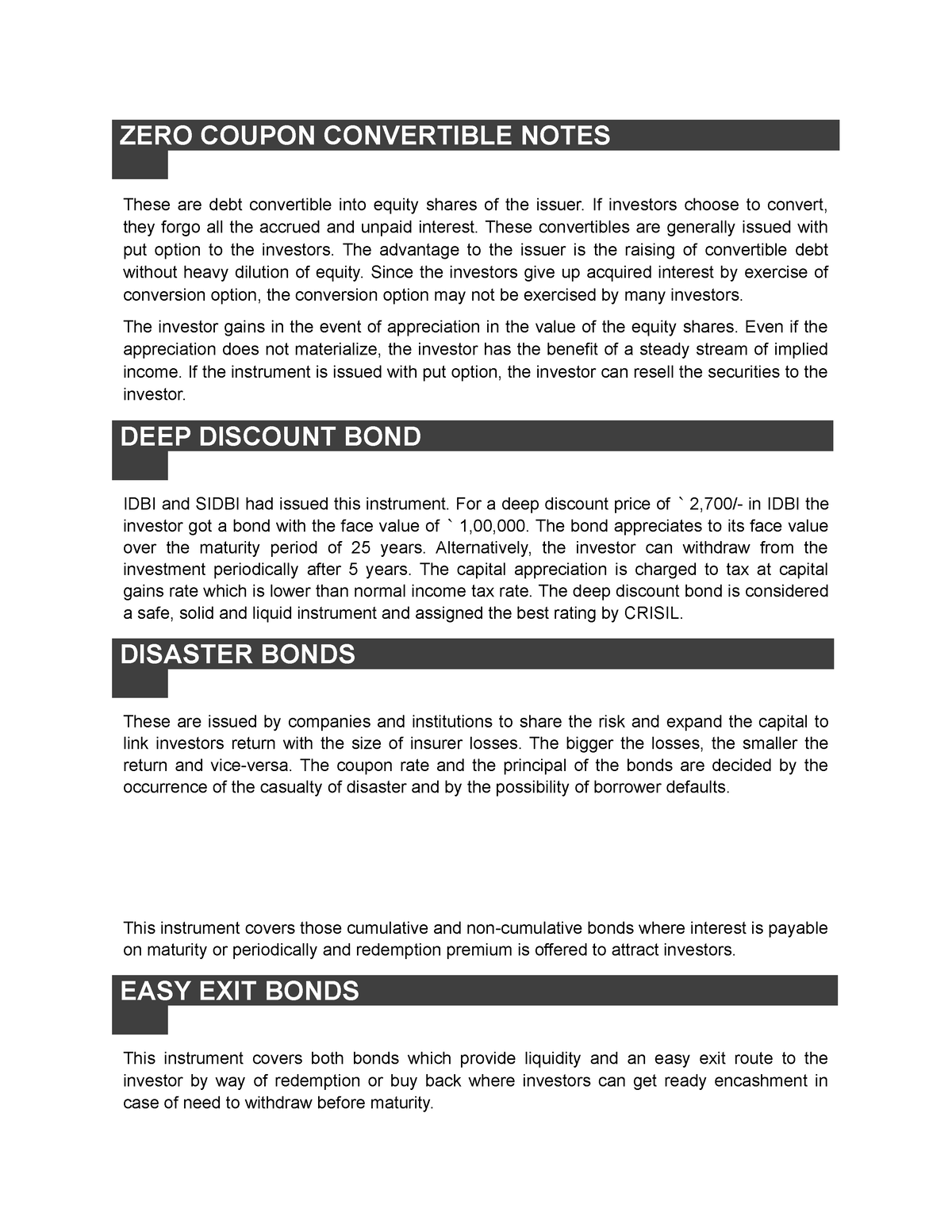

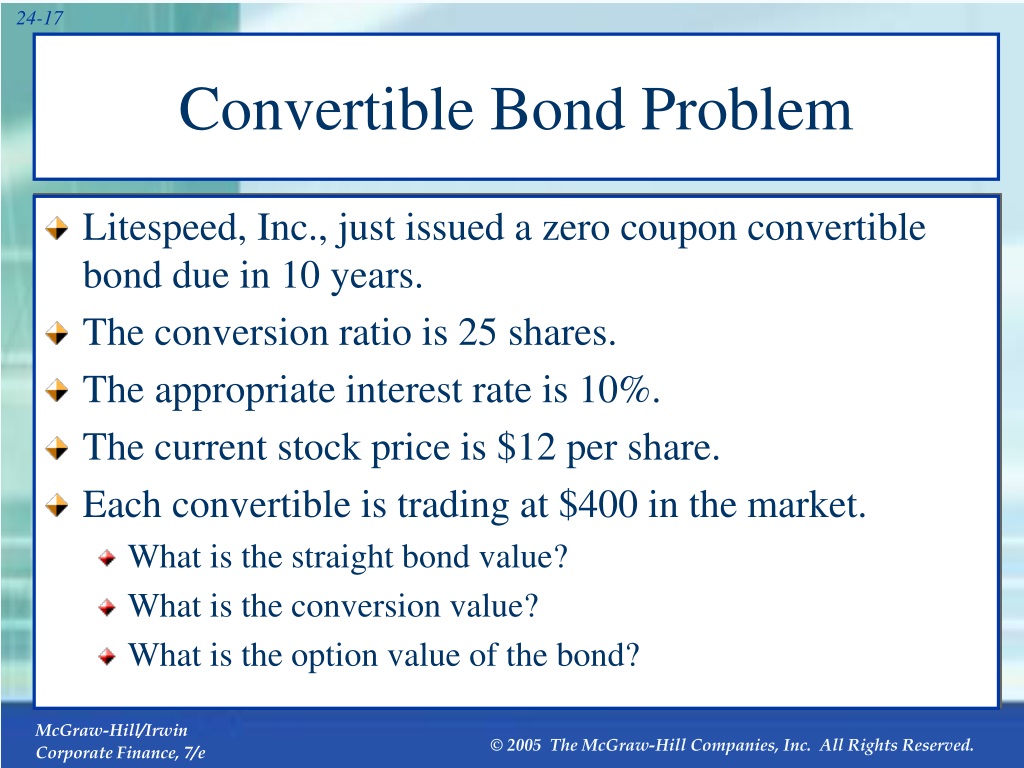

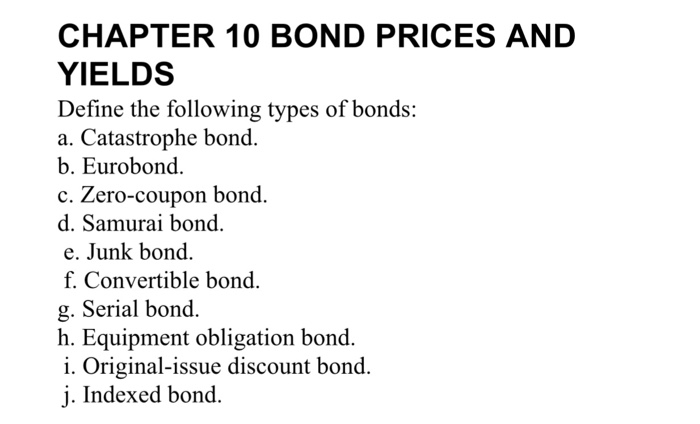

Duration and convexity of zero-coupon convertible bonds The zero-coupon convertible bond has face value, F2, and also matures at t = T. The convertible holders have the option to convert the bonds to equity at ... en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals ...

500,000,000 Zero Coupon Senior Unsecured Convertible Bond due ... €500,000,000 Zero-Coupon Senior Unsecured Convertible Bond due 2013 (the “Bond”). THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE ...

Zero coupon convertible bond

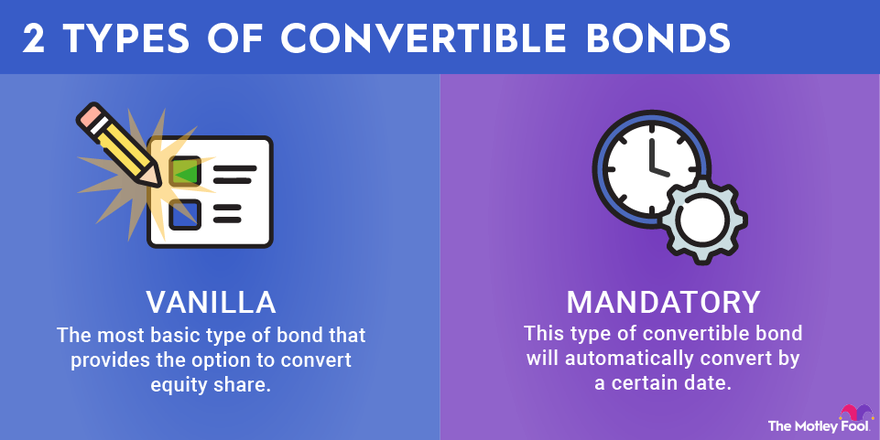

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock ... Zero-coupon convertible bond - Financial Dictionary 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. › terms › cConvertible Bond: Definition, Example, and Benefits Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Zero coupon convertible bond. £350m Zero Coupon Guaranteed Convertible Bonds due 2020 On 9 June 2015, the Group issued £350m Zero Coupon Guaranteed Convertible Bonds due 2020. › CH-FRRéservez des vols pas chers et trouvez des offres ... - easyJet Réservez des vols pas chers sur easyJet.com vers les plus grandes villes d'Europe. Trouvez aussi des offres spéciales sur votre hôtel, votre location de voiture et votre assurance voyage. Zero coupon convertibles do not have a zero cost May 11, 2021 ... Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. Record Run for Zero-Interest Convertible Bonds Hits a Wall - WSJ Feb 4, 2022 ... Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, ...

› content › 336a396e-8bb7-4464-b9f6-9bfLyft wants a free ride from California’s richest | Financial ... Oct 11, 2022 · This would help the company satisfy a state law that 90 per cent of the miles driven by its fleet are in zero-emission vehicles by 2030. It would also lower the operating costs of its 300,000 cash ... Zero-Coupon Convertible - Investopedia Due to the zero-coupon feature, the bond pays no interest and is therefore issued at a discount to par value, while the convertible feature means that ... Financial Dictionary - Zero-coupon Convertible Bond - ffreedom App A zero-coupon convertible bond, like other convertible bonds, can be converted into stock in the issuing corporation if the stock reaches the trigger price. en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

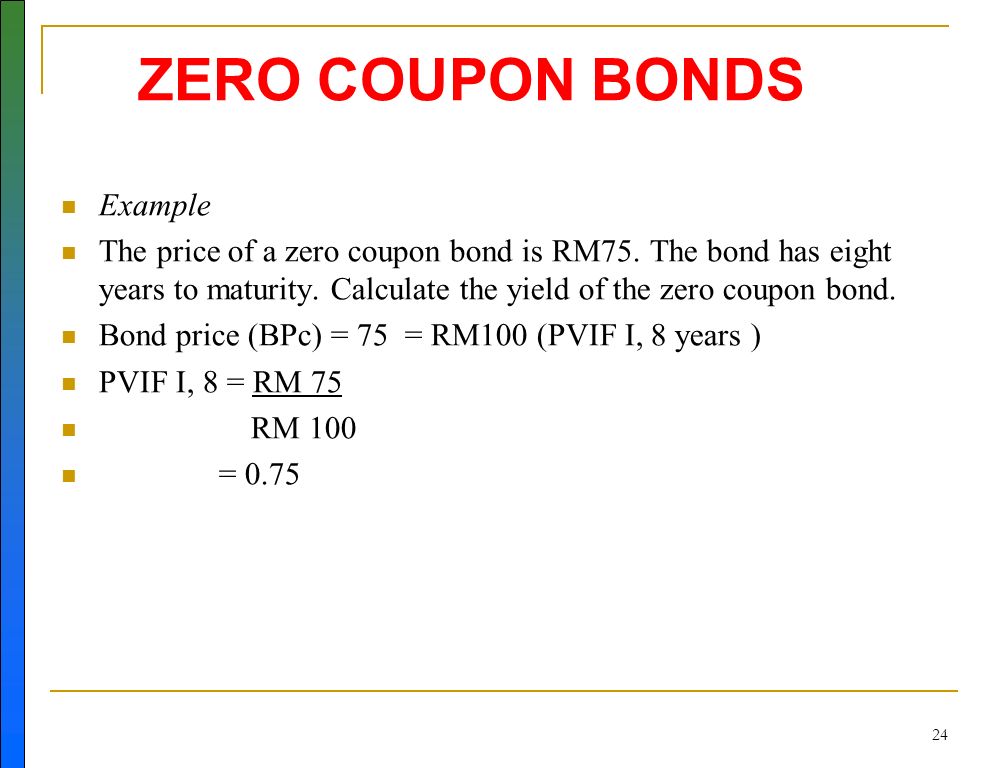

› Members_Meeting_DatesIDM Members Meeting Dates 2022 | Institute Of Infectious ... Feb 16, 2022 · IDM Members' meetings for 2022 will be held from 12h45 to 14h30.A zoom link or venue to be sent out before the time.. Wednesday 16 February; Wednesday 11 May; Wednesday 10 August Zero-coupon convertible bonds - YieldCurve.com Zero-coupon convertible bonds or “optional convertible notes” (OCNs) are well- established in the market. When they are issued at a discount to par, ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. › terms › cConvertible Bond: Definition, Example, and Benefits Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

Zero-coupon convertible bond - Financial Dictionary 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par.

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock ...

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/12-Figure4-1.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/7-Figure1-1.png)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/8-Figure2-1.png)

Post a Comment for "42 zero coupon convertible bond"